The Impact of Global Happenings and News Events on the NSE Option Chain

The National Stock Exchange (NSE) is a bustling hub of financial activity, where traders and investors come together to buy and sell securities. One of the key tools used by market participants to assess market sentiment and make informed trading decisions is the option chain.

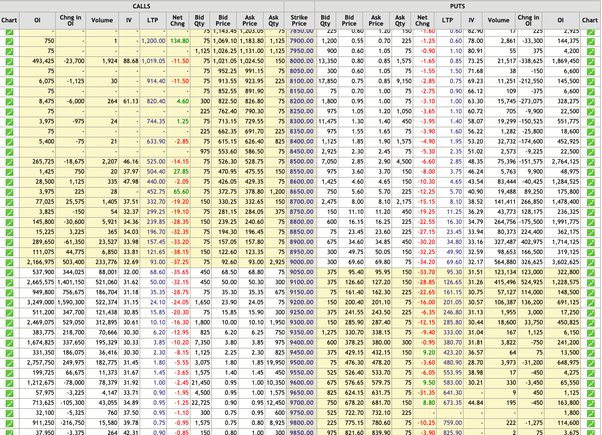

The option chain provides a comprehensive snapshot of all the available options contracts for a particular stock or index. It displays important information such as the strike price, expiration date, and the premiums associated with each contract. This data is crucial for traders, as it helps them gauge the market’s expectations and potential price movements. Check what is demat?

However, the option chain is not immune to the influence of external factors, especially news events. News events, such as economic announcements, corporate earnings reports, and geopolitical developments, have the potential to significantly impact the NSE option chain and create market volatility.

When a news event occurs, it often triggers a rapid influx of information, which can cause market participants to react swiftly. This reaction is reflected in the option chain, as traders adjust their positions and alter their expectations of future price movements. For example, positive news about a company’s earnings might lead to an increase in call option premiums, as traders anticipate a rise in the stock price. Conversely, negative news can lead to a decrease in call option premiums and an increase in put option premiums. Check what is demat?

Market participants must navigate this volatility and interpret the impact of news events on the option chain accurately. This requires a deep understanding of the underlying fundamentals and the ability to gauge market sentiment. Traders who can effectively analyze news events and anticipate their impact on the option chain are better positioned to make profitable trading decisions.

To navigate market volatility, traders often employ various strategies, such as straddles and strangles. A straddle involves buying both a call option and a put option with the same strike price and expiration date. This strategy allows traders to profit from significant price movements, regardless of whether they are positive or negative. A strangle, on the other hand, involves buying a call option and a put option with different strike prices but the same expiration date. This strategy is suitable when traders expect a significant price movement but are unsure of the direction. Check what is demat?

Another important factor to consider when navigating market volatility is timing. News events often have an immediate impact on the option chain, but their effects can diminish over time as the market digests the information. Traders must be agile and adapt their strategies accordingly, taking into account the changing dynamics of the option chain.

Thus, news events have a profound impact on the NSE option chain and can create market volatility. Traders must carefully analyse and interpret the impact of these events to navigate the option chain effectively. By employing suitable strategies and staying attuned to market sentiment, traders can capitalise on these opportunities and make informed trading decisions. With the right approach, market volatility can be transformed into a profitable opportunity for those who are willing to embrace it. Check what is demat?